Affiliate Stattement: As an Amazon Associate and an affiliate for other programs, I earn from qualifying purchases. I may receive commissions for products or services, at no additional cost to you.

The SBA has begun the process of reaching out to individuals who may be eligible for the Covid-19 Targeted EIDL Advance, inviting them to apply for the additional funds.

If you received an invitation to complete the application, this post is here to help you walk step by step through how to fill out the application for the Covid-19 EIDL Targeted advance grant, focusing especially on independent contractors with gig economy apps like Doordash, Instacart, Uber Eats, Grubhub, Uber and Lyft and others.

Note that this is written with a particular focus towards independent contractors and self employed individuals. I write especially about the business side of being a gig economy contractor.

If you run or manage a larger business, hopefully this can still be helpful for you. Just be warned that some of this content focuses on contractors who do not have employees, so some things may be different for you.

Warning: This is a LONG article. I include a lot of text from the SBA email and application. Use your own judgment to determine how much to read through, and how much to skip past.

I will post the outline here to let you jump ahead if you prefer. Here's what we'll cover:

The targeted EIDL advance was something added in the stimulus package passed late December of 2020. As of mid February, the SBA is just now getting around to processing applications.

The purpose of this targeted advance is to provide a larger amount of relief to businesses, sole proprietors and independent contractors who received less than the full $10,000 advance that was part of the original Covid-19 EIDL advance from early and mid 2020, and who were truly impacted by the pandemic.

Priority in this round of funding will be given first to those who received the earlier advance but did not receive the full $10,000. Second priority will be those who applied but never received an advance due to lack of funding.

In some ways you could say the targeted advances are an effort to ‘make whole' the previous advances under the CARES Act earlier in 2020.

The intent of the act was to have all businesses receive a $10,000 advance that did not have to be paid back. The SBA later added the rules that defined that it would be $1,000 per employee up to ten employees.

Independent contractors and self employed individuals were eligible for the grant. However, those of us who don't have employees could only receive a $1,000 advance. And that's all we received, if we did apply.

The purpose of the targeted grant this time around is to complete that original intent for businesses who truly were impacted by the pandemic. Thus, if your business received less than the $10,000 the first time around AND you can demonstrate the need as defined by the new criteria, you may qualify for an additional advance or grant.

The total of the original advance and the new grant are not to exceed $10,000. Language in the latest act specifically states that funds are not to be based on the number of employees.

As I write this the only thing that is not completely clear is whether there are other limits on the funding. In particular, some loans that were approved (based on 2019 income) beyond the advance were less than $10,000. I haven't seen language that addresses whether the grant would be limited to whatever the approved loan amount would be.

The latest act added three new criteria.

For those of us who are independent contractors with Doordash, Uber, Instacart, Lyft etc., the 300 employee thing is obviously not an issue. The original limit was 500 employees. If your business is part of this first round, has received an advance before and you do have a lot of employees, chances are you already received the maximum.

Your business address needs to be in a low income tract. For most of us who are 1099 contractors, that's your home address. You can get more details about what it means to be in a low income area and how to find the specific details for your area here.

The economic loss piece gets a bit trickier. In the original application, you only needed to have information off your 1099 from 2019. This time around you need much more specific week by week numbers.

The criteria is that for any 8 week period after March 1, 2020, if gross earnings were more than a 30% loss compared to the same 8 week period of the year before, you would qualify. That's the earnings before expenses are taken out. You can read more about economic loss reqirements here, or you can access the tool we put together where you can enter your weekly income and identify if there's an 8 week period where you had a loss.

You have to get an invitation.

This is a “don't call us, we'll call you” kind of thing. There is nowhere to go after this particular grant, you have to be invited by the SBA in order to apply for the targeted advance.

Remember that the priority for the additional funds is to go first to those who received the initial advance, then second to those who applied but then grant funds were no longer available. The SBA has your information, and they will reach out.

They have started sending out the email to invite people to verify information and to provide a first round of information.

Read the email carefully. I'll include a lot of it in this article. However, in the event it does change, if you do get the email, read through it. There's a lot of information that is important to know.

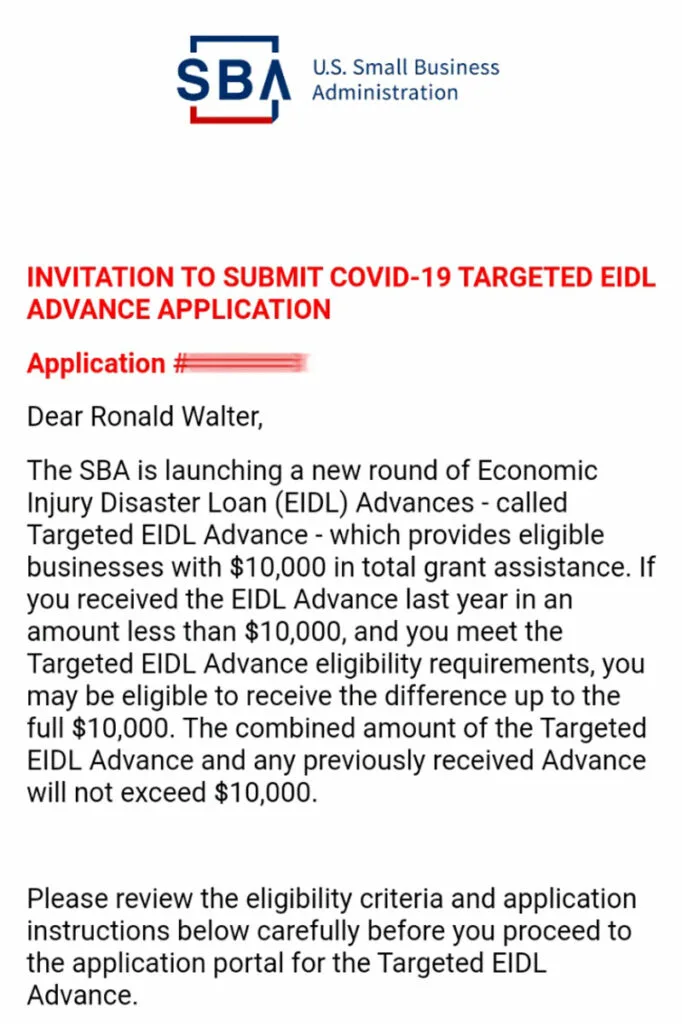

I'll post some screenshots. It's a really long email otherwise.

Depending on the screen you're looking at, it might be hard to read this. So here's the quote:

INVITATION TO SUBMIT COVID-19 TARGETED EIDL ADVANCE APPLICATION

The SBA is launching a new round of economic injury disaster loan (EIDL) Advances – called Targeted EIDL Advance – which provides eligible businesses with $10,000 in total grant assistance. If you received the EIDL Advance last year in an amount less than $10,000 and you meet the Targeted EIDL Advance eligibility requirements, you may be eligible to receive the difference up to the full $10,000. The combined amount of the Targeted EIDL Advance and any previously received Advance will not exceed $10,000.

Please review the eligibility criteria and application instructions below carefully before you proceed to the application portal for the Targeted EIDL Advance.

The email went on to lay out criteria for the grant. A screenshot of that criteria is shown in the eligibility portion of this post above.

We recommend that you have a copy of your 2019 Federal Tax Return on hand to assist you in completing the Targeted EIDL Advance application questions. You will also be asked to confirm that the information provided in your original EIDL application is still accurate. If there are any changes, you may be asked to provide documentation in order to determine if you are eligible for a Targeted EIDL Advance. Applicants that pass the initial eligibility requirements will also be required to electronically sign an IRS Form 4506-T allowing SBA to obtain tax transcripts directly from the IRS before we can approve your request for the Targeted EIDL Advance.

SBA's goal is to process all requests within 21 days of receiving a completed application. All application decisions will be communicated via email. Due to limited available funds for the Targeted EIDL Advance program, SBA will not be able to reconsider applications through an appeal process, so please make sure that your information is correct when submitting your application.

I've heard comments that the original grant was funded almost immediately, and this time they're saying 21 days out. I think this is reasonable considering they have to verify eligibility. That can be time consuming.

The rest of the email gets into some important things you need to know about having the right banking information. I'll add some more screenshots of that information below.

This is taking some time to roll out. I first started hearing of people getting their invitation about a week ago. I think they're doing this in waves to make sure they get it working correctly.

If you received the initial grant and haven't received an invitation email, double check that the email you used for the initial application is good. Check your spam filters or promotional folders or anything like that.

The thing to watch for is when the SBA begins moving on to second priority applicants. That would indicate they've moved through everyone who originally received the grant. I'll try to stay on top of events and will update this section if I hear that has happened.

If you feel you should have received an invitation and do not get one by March or so, you may want to contact the SBA. You can contact them at TargetedAdvance@sba.gov or by phone at 800-659-2955. As I mentioned at the start of this section, the first thing is wait. It's going to take some time. If you reach out now (mid February) you may not get a response yet.

If you applied before December 27, 2020 but did not receive the advance due to funds being out, you are next in line. The same answer holds for you: wait.

The SBA is first moving through everyone that did receive the advance. Once they've covered all of those, they'll move on to you.

If you did not apply for the EIDL program at all, it does not appear there will be anything in this round that you qualify for. They do not seem to be opening up new applications.

If there's one thing we learned from the original release of the EIDL and PPP programs, it's to act quicly.

If you receive the invitation email, do not waste time responding. They make a point to say that funds are limited.

My recommendation is to make sure you have your information ready ahead of time. In particular you want to make sure you have your financial information together and make sure you have all the information for your bank account (and the right kind of bank account).

The thing is, you want to get it right. A lot of people who applied for funding under the Paycheck Protection Program and the EIDL did not receive funding for one reason: They were sloppy with their application. They put the wrong information down about their business or about their bank account.

I read more people comment in forums about problems with their bank info when they applied the first time around. By the time they had everything straightened out, funds were gone.

Get your stuff together. Get it right. Treat this like a business application, not some quick easy survey you're getting money for. Do it right and you greatly increase your chances.

Interestingly, the burb from the email above states that you want to have your 2019 tax return handy. When I ran through the application, there wasn't anything that required info from my tax return.

However, they did ask for my monthly income from 2019 on.

To be fair, the part of the email that tells about qualifications says you will need this. It says you must have:

Suffered economic loss greater than 30 percent as demonstrated by an 8-week period beginning on March 2, 2020, or later, compared to the previous year. You will be required to provide the total amount of monthly gross receipts from January 2019 to the current month-to-date.

SBA's invitation to apply email, section on criteria for the targeted EIDL advance.

I'm curious. Will they follow up with a request for weekly totals? Or are they going to stick with the broadest (and simplest) possible scope where they look at 8 weeks as two months.

What if your period of economic loss begins in the middle of a month? Will that disqualify some who should otherwise be qualified?

The terminology really throws people off.

“Gross receipts” does not refer to those restaurant receipts that are covered in grease and food stains. While those are indeed gross, that's not it.

In accounting terms, that's your money received after cost of goods sold.

Put real simply, for those of us who are gig economy contractors, that's the money you received from Doordash, Uber Eats, Instacart, Uber, Lyft, Grubhub or other gig apps.

If you do other work, such as flipping merchandise on eBay or Amazon, gross receipts is what you received for your sales minus the cost of buying the items.

This is not the same thing as your net profit. Gross receipts is your money BEFORE your expenses.

Note: If you had more than one schedule C, you'll need to add up the gross revenue from all of them.

You're going to have to go back now and look up your earnings, month by month, since January 2019.

If you haven't been doing this so far, this is a good time to put it into a program that will give you a proper report. Chances are the SBA is going to ask for documentation of these monthly amounts.

For independent contractors, you're probably going to need one or both of the following:

A monthly profit and loss report. If you are using a program like Quickbooks, you can pull up a report and choose to show monthly columns. It would look something like this:

You can get this kind of report on Quickbooks Online or the Desktop version. Other programs like Freshbooks or Wave also have this ability. Even GoDaddy Bookkeeping will give you a monthly breakdown.

Some programs like Hurdlr and Quickbooks Self Employed will require you to run individual Profit and Loss statements for each month.

And then there's Stride. Forget about it. There's no reporting capability. All you can do is download the data and do the math.

If you had more than one schedule C, you'll want to run your numbers for all of your businesses individually.

In some of their guidance, the SBA has talked about bank records as one form of documentation.

I don't know yet if the P&L statements will suffice. For that reason, I recommend you go ahead and get your bank records together now. Here's what I would recommend:

The SBA makes a big deal of this in their email. They point out that one reason a lot of applications don't get approved is because it's impossible to transfer funds based on the information provided.

Whether this is a legitimate excuse or not, here's the thing you have to understand: The SBA is overwhelmed trying to get all this processed. They're having problems with the PPP program. They're delayed on EIDL.

They don't have the manpower to hunt down bad bank account information. Whether they should or not, that's another discussion.

Have your act together now so they can't make that excuse.

Here's a screenshot of that section:

I told you they make a big deal out of it.

This is seriously nearly half of the entire email, and it's all about just making sure you have the right information.

I won't quote the entire thing but here's what it boils down to:

It is very important that you double-check your bank account information carefully before submitting. Incorrect or incomplete information may result in an inability to approve your request or successfully disburse your funds. Carefully review the information below regarding bank account deposits.

SBA invitation email for targeted EIDL advance application, section on having correct bank information.

Take this seriously. If you screw this up there may not be an option to go back and get it right later.

Here's a summary of the points they make in the email:

I have to be honest. I read through this and I think… do they really have to stipulate all this? When you read the language they used, you can tell that these were common problems during the first round of applications.

Use an account that is yours and that the details match your contact information and name provided on the application.

Get the account details right.

Make sure it's a checking account that can accept ACH payments.

And oh, by the way… Get the account details right.

It really was pretty simple to walk through the application. Since this is all sent out to people who have already been through the EIDL process, most of it is done for you. I'll walk through what was all on the application.

I won't bother with the link, because every link is personalized. It looks like this on the email.

Hit the button. Enter your social security number (or EIN if you used one on your first application). And away you go.

We start off with 23 questions. Most of these are pretty simple and straight forward. You can't be involved in certain kinds of business. You can't be a criminal.

And then there are a few other things that might surprise you.

Here's a screenshot of the whole set of questions. Then I'll comment on questions to clarify where it seems necessary. Some questions probably need no explanation.

Applicant must review and respond to all of the following questions. Please note that “owner” includes each proprietor, each limited partner or LLC member who owns 20% or more interest, each general partner or managing member, and each stockholder or entity owning 20% or more voting stock. If applicant does not meet the initial eligibility requirements, Applicant will not be able to proceed to the remainder of the application.

Introduction to Eligibility Questions on the Targeted EIDL Advance application.

Note from this that generally you are answering for yourself. If you have a legal partnership or an LLC with more than one member, you need to answer related to all owners.

One other thing that may lead to some confusion. Applicant refers to the business, not to you as an individual. That's an important distinction in some future questions. If you read “Is the Applicant,” read it as “Is the business.”

Every year, I submit two Schedule C forms with my taxes. One is for my delivery work. The other is for my website and online marketing. That's because all of the miles I drive are not consistent with online work, but all the website costs and office costs are not consistent with delivery work.

What do you do if you have more than one business on some of these questions? Which business are we talking about?

If it's a business that you're filing information on as part of your individual tax return, the best answer is “all of them.”

In their guidance on documentation for Revenue Reduction in the Paycheck Protection Program, the SBA kind of backs up this idea. In a footnote on Page 4 they mention that if you have multiple schedule C's, you need to add revenue from all of them.

If you file multiple Schedule C forms on the same Form 1040, you must include and sum across all of them.

Footnote 5, page 4 of SBA Guidance on How to Calculate Revenue Reduction on PPP Loans.

I'm looking for similar documentation on the EIDL but since they are both administered by the SBA, I'm pretty sure they're the same.

If you're required to add up all revenue on all your Schedule C's, it's safe to say that you should be answering the questions based on all businesses, not just one. I think that will be most relevant in questions 11 and 20.

That first phrase backs up what I was saying. “Are all owners of the Applicant.” Read it as “Are all owners of the business.”

If you are filing as a self employed individual or sole proprietor, answer only for yourself. If you have a legal partnership where an ownership structure is defined, then you'll need to answer for all your owners.

The bottom line is, are you able to work in the US legally?

If you stormed the Capital and got busted, you need not apply. If you committed a felony during any of the unrest or related to a disaster, you can probably stop right here.

While this seems straight forward, make sure that the key here is “determined to be obscene by a court of competent jurisdiction.”

I'm not a lawyer, but I would take this to mean, have you been arrested and being charged for a felony?

Have you been convicted of a felony or did you plead no contest to a felony? This isn't about whether you were ever charged, just if you were convicted or placed on probation for a felony.

Understand the distinction here that they're asking about the Applicant. That means your business, not you as an individual.

You're thinking “wait, marijuana is legal where I am.” I'm sure someone somewhere reading this might work at a dispensary. Why do they say illegal?

Even though states have legalized it, the Federal government hasn't yet. Businesses engaged in the sale of marijuana are not eligible. This is an important distinction.

The question at hand is, is your business, for which you're applying, involved in the sale of marijuana? This article is geared mainly towards gig contractors – and unless your gig actually deliveres marijuana, you're probably okay here.

If you're operating a strip club or porn or selling stuff around all that as part of your business, you may not qualify.

Maybe you won big in a poker tournament. Does that mean you can't apply because of this? After all, didn't we say “Applicant” means your business?

Check out the section before the first question. The SBA requires you to add information up from all of your Schedule C forms. If you reported profit and loss on a Schedule C for gambling winnings, my understanding is you have to include your gambling financials as part of your bsuiness.

Here's another one where it's important to recognize “Applicant” as the business. You as an individual are not prohibited from political activity. It just means a lobbying business can not receive this assitance.

I wonder, are there any members of Congress who are doing Doordash or Uber Eats as a side hustle?

I have to admit, the first time I read this question, I was thinking, “wait, what?”

I'm not sure my meager Roth IRA contributions could be called investing. But still, are you saying I can't invest?

Remember, Applicant means your Business. Is investing the nature of your business? Now if you're trying your hand as a day trader and reporting the profits and losses on a Schedule C, you might be. But as a delivery or rideshare contractor who has some investments as an individual, that's different than investing being a part of your business.

Are you involved in multi level marketing? Think Amway, Herbal Life, Mary Kay, Avon, Primerica. The SBA doesn't allow financing if involved in network marketing.

Does it matter though if your business is actually gig delivery or rideshare? Based on information I mentioned above about how the SBA wants you to handle multiple Schedule C's, if you filed a Schedule C for your network marketing business, it appears you do have to answer based on that.

If you are engaged in a network marketing company and you wonder if you are impacted by this question, you may want to reach out to resources there and find out what they would advise.

Since this blog is about third party delivery, I'll bring this one up. I've talked a little about TripDelivers, a company that recently launched deliveries in Nashville with supposed plans to go nationwide.

I've seen some accusations that they're really a multi level marketing company. I notice they're listed in a report on a website called MLM Gateway. There are some things about their pay model that bear some resemblance to MLM plans. The question is, does the SBA consider them a MLM company? I doubt they do, but how do you know?

Again, this question is about your business. Because you personally invested in an REIT does not mean that your business is engaged in this. The determining factor is, are any of the income and expenses on your Schedule C related to this type of business.

I wrote about this related to the original EIDL application process. At the time I wrote that as self employed individuals or sole proprietors, we have no employees. I also linked to this article from Gusto that said “If you’re a sole proprietor and don’t have any employees, put zero.”

If you said 1 the first time you applied, and you received the advance, it's obvious that listing 1 was not a problem. If you remember for sure what you put down the first time around, I don't imagine it would be bad to stay consistent with what you put on your original application.

However, if you're not sure, zero isn't a bad answer to go with.

Once you've checked through your eligibility, you move on to this screen.

It's pretty straight forward. All of this is information from your previous application. If you were funded, there's less likely to be any issues. However, pay attention to their instructions.

Once again, the print is small. I won't walk through all the fields because it's information you previously provided. I am going to break up the introduction paragraph into bite sized chunks because it's important stuff.

The information below was submitted with your previous application. Please confirm that it is still accurate for your business or organization. Revise any information that has changed.

For most of us things probably haven't changed much since applying. However, if you've had an address change or other contact information has changed, be sure to update that here.

If you do have a different address, make sure you match up with what you will put on your income tax return. The only time you would have a different address that I can think of than your personal address is if you actually rent out an office to operate your business out of.

Do not make up an address just to try to qualify for the low income area qualification. A change of address from a non qualifying address to one that does qualify could easily raise a red flag. If you did make a move, prepare to have documentation that proves your new address.

Ensure that the legal name of your business is entered correctly and that it matches your 2019 tax return; this would be the business owner's name in some cases, such as a Sole Proprietorship or Independent Contractor, where a separate business tax return is not filled.

Just the fact that they have to spell this out tells me this tripped a lot of people up on the original application.

I feel the need to show this. This was from the original application:

I kind of ranted on this when I posted a guide for applying. I did all the “online shouting” posting in Red and using all caps.

Do not, I repeat, DO NOT put Grubhub or Doordash or any other company down for the business name.

My commentary, in all its italicized capitalized boldened glory, on what to put down for Business Name on the EIDL Application.

So I find it interesting and a bit humorous that they felt the need to go into detail on this this time around. That makes me think a lot of people put the wrong thing down here under business name.

I wonder how many didn't get approved.

Does this sound like beating a dead horse? Given the amount of space the SBA dedicated to this topic in their invitation email, they're consistent by addressing it again.

Bank name should be the official name of the bank; please contact your bank if you are unsure. Ensure that you provided a checking account to facilitate the ACH payment.

The bank account you provide must satisfy the following: (1) Account opened using your business legal name; (2) Account has your business address and phone number; (3) Account opened using your business tax identification number (EIN, or SSN if no EIN registered).

One line here is interesting to me:

“Account opened using your business legal name;”

Go back to the line before. If you're filing under your social security number, as most of us in the gig economy are doing, your business legal name is YOUR name.

So guess what happens if you put “Doordash” down as the business name and the SBA sees your bank account isn't under Doordash?

Pay attention to what you're filling in here. Make sure you're putting the right kind of bank information in, which won't be an issue if you did your prep correctly.

Once you've confirmed information from the previous information, you'll come to a section they call “NEW INFORMATION.”

Complete the monthly gross receipts for each year listed on the form. Gross receipts include all revenue in whatever form received or accrued, from whatever source. If there was a period with no sales, please enter 0.

It's interesting. The act states that economic loss is for any earnings after March 2, 2020, however they ask you for earnings back to January on this form.

I'm also a bit intrigued that they didn't ask for weekly earnings.

Note that there's a space for January, 2021. You'll need to fill that in as well. If you fill this out in March, it's possible you'll need to enter information for February, and so on.

Remember that if you have multiple schedule C's, you'll need to make sure you have added up your gross reenue for all of them.

Once you've done this, you get to the final screen.

Pay attention to what you're agreeing to here. You're stating you realize that you're submitting this under penalty of perjury.

Warning: Any false statement or misrepresentation to SBA may result in criminal, civil or administrative sanctions including, but not limited to: 1) fines and imprisonment, or both, under 15 U.S.C. 645, 18 U.S.C. 1001, 18 U.S.C. 1014, 18 U.S.C. 1040, 18 U.S.C. 3571, and any other applicable laws; 2) treble damages and civil penalties under the False Claims Act, 31 U.S.C. 3729; 3) double damages and civil penalties under the Program Fraud Civil Remedies Act, 31 U.S.C. 3802; and 4) suspension and/or disbarment from all Federal procurement and non-procurement transactions. Statutory fines may increase if amended by the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015.

I hereby certify UNDER PENALTY OF PERJURY UNDER THE LAWS OF THE UNITED STATES that the above is true and correct.

In other words, they're not playing games here.

Do not be sloppy about this. Don't guess. Don't go off the cuff. Have your numbers together. This is a business application with a government agency. Treat it that way.

And don't be tempted to fudge the numbers to make it so you qualify. That's when you're really getting in trouble.

The invitation email said it could be up to 21 days after you submit your application.

If your application meets threshold eligibility requirements for the Targeted EIDL Advance, you will receive an email requesting that you log in to the customer account portal to complete and sign a Request for Transcript of Tax Return (IRS Form 4506-T) for your business or organization. You must complete this task in order for your application to be considered. Submitting this form does not guarantee that your application will be approved.

Here's what it looks like will happen:

They will check your business address and see if it meets the Low Income Area criteria.

Then they'll check your income that you submitted. I don't know if they'll drill down further into week by week numbers. If you have two consecutive months in 2020 (or 2021) that added up to more than a 30% loss of revenue when compared to same two months the year before, then it's safe to say you met the 8 week criteria.

If it's close, will they ask for more detailed weekly information? I don't know.

The language in their closing paragraph indicates tehre will be a follow up if you appear to qualify. Part of that will be to let them pull up your tax records.

The thing is, tax records don't give any month to month information. The only thing they can do with that is compare them to your total earnings.

So it's a good idea to make your monthly totals equal what you put on your tax forms.

When I find out if they are asking for other supporting documenation, I'll update this information accordingly.

Other than that, now it's just wait.

Could this help someone else? Please share it.